Project Brief

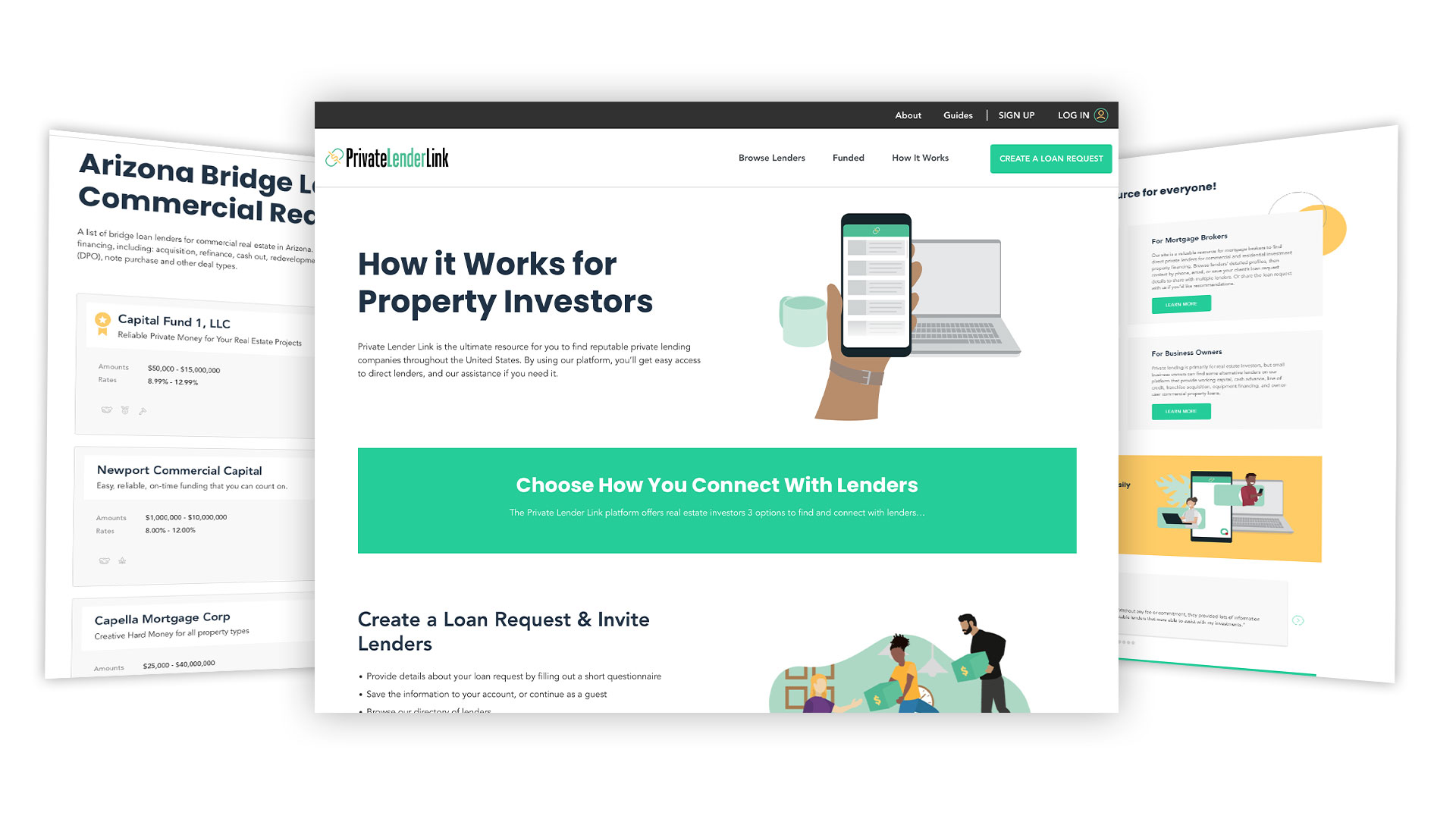

Our relationship with Private Lender Link began in 2017 with the complete rebuild of their online marketplace. And we’ve been their trusted digital partner ever since.

In late 2021, the desire to introduce new design and user experience updates led to a reimagined model of how their customers fundamentally interact with the website.

Our Solution

It is not a new website, but a redesign and overhaul of existing features – Optimizing the loan application process, reducing friction when messaging, and refreshing the UI to be modern and fresh- were all on the task list for this massive update!

Upgrading the Business by

Updating The Website

One of the key ways Private Lender Link generates revenue is by taking a small commission on loans processed through the marketplace.

Previously, a borrower needing a loan would browse the directory of lenders and manually apply to each qualified institute. It’s a very one-to-one method that was a bit repetitive, but it worked and served PLL users for many years.

We re-engineered that process and took a complete 180-degree approach! Rather than manually applying and submitting loan applications to individual lenders, borrowers now “create a loan request” and simply invite lenders on the platform to view the details so they can apply to fulfill the loan request.

The borrowers spend less time applying for the same loan. The lenders get access to more requests. And deals are funded quicker and more efficiently – a win for everyone involved!

At inception, Private Lender Link was the directory. Now, they’re the go-to service for getting hard-money loans funded.

+30%

Increase in Pageviews

+24%

Increase in New Users

Simplifying Loan Applications

We broke the lengthy application process down to 6 simple steps that guide people through completing the form. By using conditional logic, certain form fields dynamically change in each step, making the user feel like they’re in control of the whole process.

Custom Profile Dashboard

Because we fundamentally changed the way loans are created and fulfilled, the backend of account profiles needed a redesign to encompass the platform’s new core functionality.

The overhauled dashboard shows top-level metrics related to the type of user account (borrow, broker, lender, service provider), and it gives users complete editing control over what information is publicly shared.

Messaging Lenders Made Easy

We wanted to make the communication between people searching for loans/services and people offering loans/services as frictionless as possible.

Alongside the built-in profile inbox, we introduced a live chat to get people connected easier and deals funded faster!

Modernizing the Design

The evolution of the business meant the brand needed to reflect those changes too.

We designed custom iconography and illustrations to communicate simplicity and ease of use, with a refreshed colour palette that compliments the existing logo that professionals have grown to recognize for nearly a decade.